Texas State Housing Exemption Form . Visit our exemptions page for more information about. Exemption requests need to be submitted prior to submitting a housing contract. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. State the year for which you. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Future and current residents should pay close attention to the terms of their housing contract. Property owners applying for a residence homestead exemption file this form and supporting documentation with. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status.

from www.slideshare.net

This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. Visit our exemptions page for more information about. Exemption requests need to be submitted prior to submitting a housing contract. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Future and current residents should pay close attention to the terms of their housing contract. State the year for which you. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Property owners applying for a residence homestead exemption file this form and supporting documentation with.

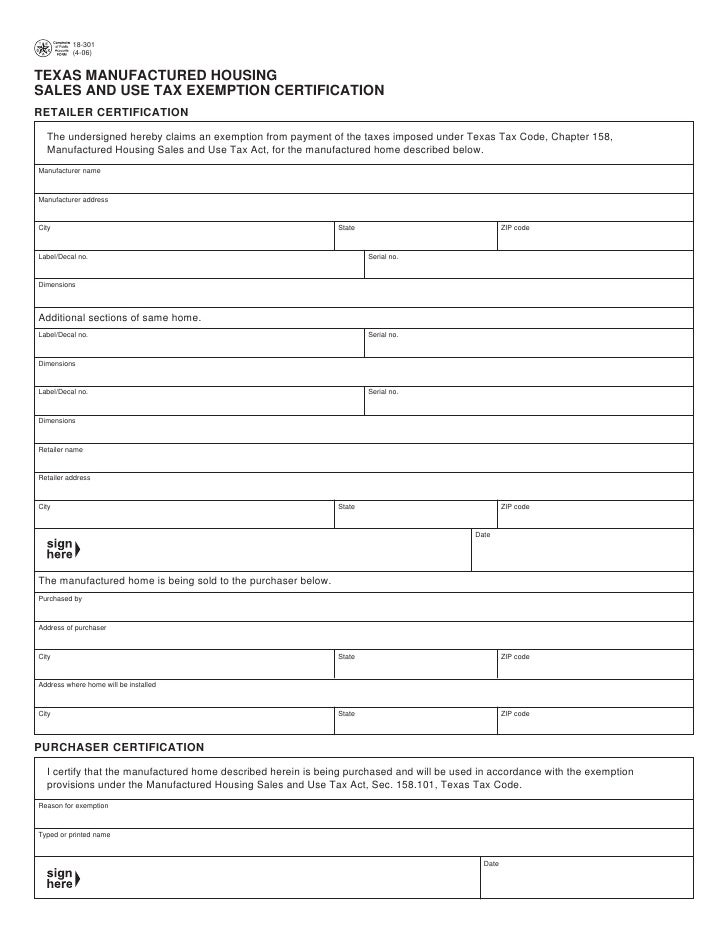

Miscellaneous Texas Tax Forms18301 Texas Manufactured Housing Sales…

Texas State Housing Exemption Form State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Exemption requests need to be submitted prior to submitting a housing contract. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. State the year for which you. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. Visit our exemptions page for more information about. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Property owners applying for a residence homestead exemption file this form and supporting documentation with. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. Future and current residents should pay close attention to the terms of their housing contract.

From www.signnow.com

TEXAS EXEMPTION STATEMENT Form Fill Out and Sign Printable PDF Texas State Housing Exemption Form Future and current residents should pay close attention to the terms of their housing contract. Visit our exemptions page for more information about. Property owners applying for a residence homestead exemption file this form and supporting documentation with. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. This. Texas State Housing Exemption Form.

From www.exemptform.com

Texas Hotel Tax Exemption Form Texas State Housing Exemption Form Property owners applying for a residence homestead exemption file this form and supporting documentation with. Visit our exemptions page for more information about. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. State the year for which you are seeking exemption(s), the date you. Texas State Housing Exemption Form.

From www.exemptform.com

Farm Sales Tax Exemption Form Texas Texas State Housing Exemption Form Future and current residents should pay close attention to the terms of their housing contract. State the year for which you. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Visit our exemptions page for more information about. Property owners applying for a residence. Texas State Housing Exemption Form.

From www.exemptform.com

Homeowners Exemption Form Riverside County Texas State Housing Exemption Form State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Property owners applying for a residence homestead exemption file this form and supporting documentation with. Visit our exemptions page for more information about. Future and current residents should pay close attention to the terms of their housing contract. Exemption requests need to. Texas State Housing Exemption Form.

From www.countyforms.com

Tarrant County Property Tax Exemption Forms Texas State Housing Exemption Form This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Property owners applying for a residence homestead exemption file this form and supporting documentation. Texas State Housing Exemption Form.

From www.pdffiller.com

How To Texas Resale Fill Online, Printable, Fillable, Blank pdfFiller Texas State Housing Exemption Form Future and current residents should pay close attention to the terms of their housing contract. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. Property owners applying for a residence homestead exemption file this form and supporting documentation with. Visit our exemptions page for more. Texas State Housing Exemption Form.

From www.templateroller.com

Form 50263 Fill Out, Sign Online and Download Fillable PDF, Texas Texas State Housing Exemption Form State the year for which you. Property owners applying for a residence homestead exemption file this form and supporting documentation with. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,. Visit our exemptions page for more information about. State the year for which you are seeking exemption(s), the. Texas State Housing Exemption Form.

From www.exemptform.com

Texas State University Housing Exemption Form Texas State Housing Exemption Form Visit our exemptions page for more information about. Property owners applying for a residence homestead exemption file this form and supporting documentation with. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. This application is for use in claiming residence homestead exemptions pursuant to tax. Texas State Housing Exemption Form.

From studylib.net

TEXAS SALES AND USE TAX EXEMPTION CERTIFICATE Texas State Housing Exemption Form State the year for which you. Property owners applying for a residence homestead exemption file this form and supporting documentation with. Exemption requests need to be submitted prior to submitting a housing contract. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. Future and current. Texas State Housing Exemption Form.

From classdbcolin.z21.web.core.windows.net

Sample Letter Of Exemption Texas State Housing Exemption Form This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. Future and current residents should pay close attention to the terms of their housing contract. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. State the year. Texas State Housing Exemption Form.

From printableformsfree.com

Texas Hotel Tax Exempt Form Fillable Printable Forms Free Online Texas State Housing Exemption Form Exemption requests need to be submitted prior to submitting a housing contract. Property owners applying for a residence homestead exemption file this form and supporting documentation with. Future and current residents should pay close attention to the terms of their housing contract. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring. Texas State Housing Exemption Form.

From www.vrogue.co

Asu Housing Exemption Form Fill Out And Sign Printabl vrogue.co Texas State Housing Exemption Form New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. State the year for which you. Future and current residents should pay close attention to the terms of their housing contract. This application is for use in claiming residence homestead exemptions pursuant to tax code. Texas State Housing Exemption Form.

From www.vrogue.co

Asu Housing Exemption Form Fill Out And Sign Printabl vrogue.co Texas State Housing Exemption Form New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Exemption requests need to be submitted prior to submitting a housing contract. State the year for which you. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Texas State Housing Exemption Form.

From www.megadox.com

Texas Application for Residence Homestead Exemption Legal Forms and Texas State Housing Exemption Form State the year for which you. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Future and current residents should pay close attention to the terms of their housing contract. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 , 11.134,.. Texas State Housing Exemption Form.

From www.sanpatricioelectric.org

Tax Exempt Forms San Patricio Electric Cooperative Texas State Housing Exemption Form Property owners applying for a residence homestead exemption file this form and supporting documentation with. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing requirement. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer. Texas State Housing Exemption Form.

From www.exemptform.com

Fillable Form 01 339 Back Texas Sales And Use Tax Exemption Texas State Housing Exemption Form State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Property owners applying for a residence homestead exemption file this form and supporting documentation with. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. This application. Texas State Housing Exemption Form.

From www.slideshare.net

Miscellaneous Texas Tax Forms18301 Texas Manufactured Housing Sales… Texas State Housing Exemption Form State the year for which you. State the year for which you are seeking exemption(s), the date you moved in, and your ownership status. Exemption requests need to be submitted prior to submitting a housing contract. New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester. Texas State Housing Exemption Form.

From www.exemptform.com

Wichita State University Housing Exemption Form Texas State Housing Exemption Form New freshmen under the age of 20 (by september 1 for fall admission or january 1 for spring admission) with fewer than 30 semester credit. Exemption requests need to be submitted prior to submitting a housing contract. This request may only be used if you have not submitted a housing contract and would like to be exempt from the housing. Texas State Housing Exemption Form.